by Sara Sousa Rebolo, President, PAIIR – Portuguese Association of Immigration, Investment and Relocation

Once again, the Portuguese Government drew a rabbit from the hat in regard to maintaining the Golden Visa Regime. After a labyrinthine process which supposedly would lead to the closing of the programme for real estate investments in the main cities, changes were published that (let’s see!) will effectively amend the programme… but only in January 2022.

In fact, although the decree was published last month, the revised rules will only come into effect from 1st January 2022 – a nod to the economic uncertainty that the COVID pandemic has created. Contrary to what had been announced, there were no big changes, but only four updates regarding minimum investment values and the introduction of only one limitation in the scope of real estate investment.

This means that, during 2020, the Golden Visa programme will not suffer any change or limitation – which is excellent news for professionals and investors who will benefit from the current regulations if their applications are filled in by 31st December this year.

On January 2022 (although nothing is absolutely certain at this stage), the investors will have the same eight options of investment available, but four of them will be more expensive:

i) Financial investment (such as a bank deposit, acquisition of public debt instruments, or acquisition of company shares), will be raised from €1m to €1.5m;

ii) Investment in research activities will increase from €350,000 to €500,000;

iii) Corporate investment through the incorporation or reinforcement of a company will be raised from €350,000 to €500,000; and finally

iv) Investment in venture capital funds will also increase from €350,000 to €500,000.

Strictly speaking, in terms of the new raised minimum costs, it looks like only the option of funds will have an effective impact. From all the investment Golden Visa options available, the investment in participation units of Portuguese funds was the one that, during 2020, benefitted from a significant increase in demand by investors, given the speed in the selection process and low associated costs of maintenance and subscription.

In terms of real estate investment – usually the most popular choice with investors – both options keep their minimum values of investment of €500,000, for any kind real estate, or of €350,000 for older properties, suitable for refurbishment. However, a newly introduced regulation will be decisive in the type of property investors will select in future.

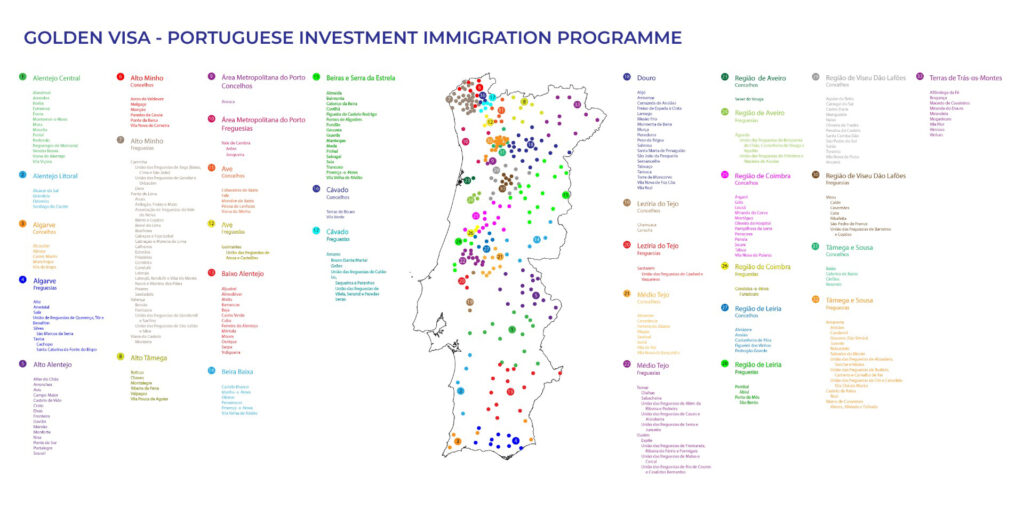

From 2022, real estate classed as residential property will only be granted access to the Golden Visa residence card if it is located in pre-selected interior and rural regions of Portugal. If the real estate has any other purpose other than housing (i.e. services, offices, commerce), its location will be irrelevant, and the investor can still apply for the golden visa if the property is located in more metropolitan areas, such as Lisbon or Porto city centre.

Considering that many investors have traditionally preferred projects designed around tourism, which can grant a good return on investment, the Portuguese Golden Visa does look as if it will remain popular for investors and give them plenty of reasons to opt for Portugal.